It is more important than ever to be financially stable today. The average American household owes $137,063 in debt, which is only going up. If something unexpected happens, like a job loss or illness, you could quickly find yourself in a lot of trouble if you’re not prepared.

That’s why it’s crucial to have a solid financial plan in place. Start by creating a budget and sticking to it as closely as possible. Cut back on unnecessary spending and put that money into savings or investments. It would help to consider buying insurance to protect yourself from unexpected costs.

It’s not always easy to be financially stable, but it’s worth the effort. Make sure to consult with an expert if you need help getting started. With a little hard work and planning, you can create a bright future for yourself and your family. Investments are one way to grow your money, but you might have to protect it. Fortunately, there are many ways to do this.

Emergency Funds

An emergency fund is one of the most important things to protect your finances. You set aside this money for unexpected costs, such as a job loss or illness. If something happens and you need to access this money quickly, you don’t want to worry about selling investments at a loss.

That’s why it’s crucial to start building an emergency fund as soon as possible. It would help if you aimed to save enough money to cover at least three to six months of your living expenses. This may seem daunting, but it’s worth it in the long run. There are many ways to save money, so find one that best suits your lifestyle.

Remember that you should not use your emergency fund for other purposes, such as paying off debt or investing in new assets. You should only use this money for emergencies. Otherwise, you’ll quickly deplete your savings and return to where you started.

Be sure to revisit your emergency fund regularly and make adjustments as needed. Your goal should be to have enough money saved, so you don’t have to worry about anything else when something unexpected comes up. An emergency fund is one of the best ways to protect your growing money.

Real-Time Monitoring

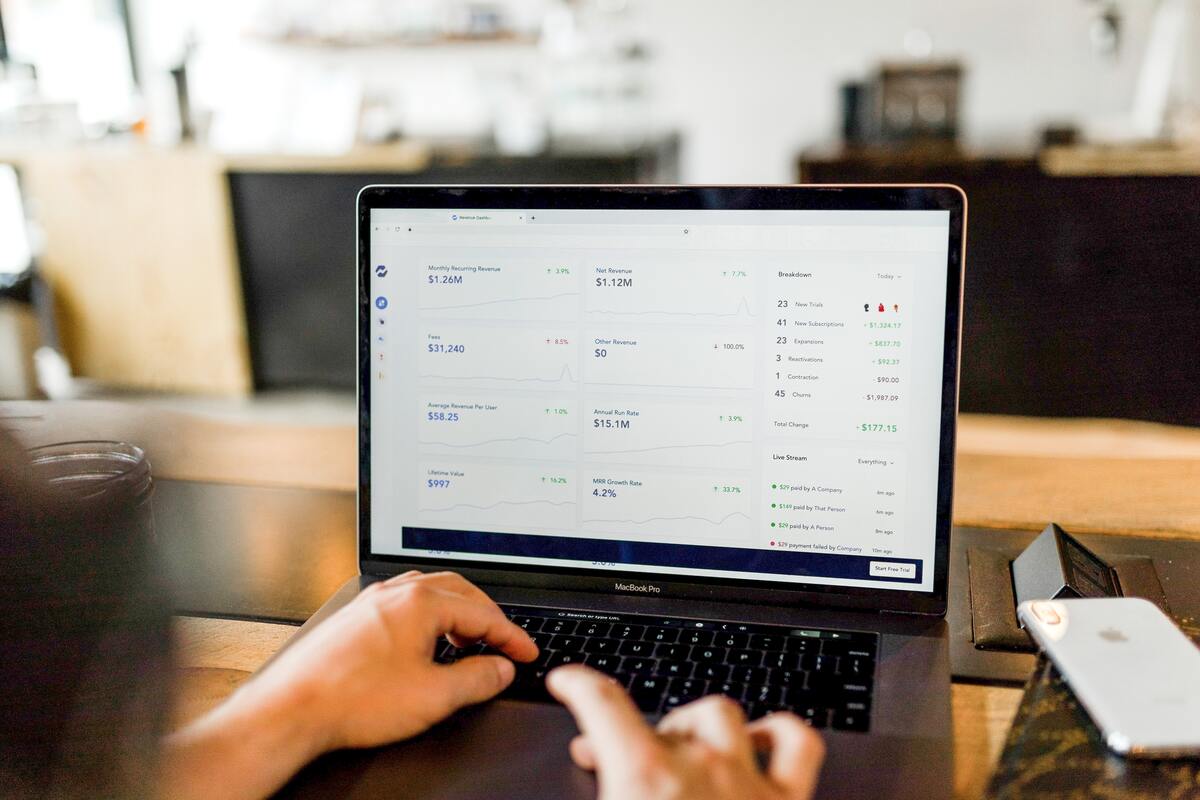

Technology has made it easier to monitor your investments in real-time. You can now use apps or websites to track your portfolio, so you know exactly how much money you have and where it’s invested.

Real-time monitoring allows you to make quick decisions based on market changes, such as selling stocks if the price drops significantly. This could help reduce losses and protect your investments.

It is also essential to keep an eye out for any suspicious activity with your accounts. Setting up transaction alerts to catch any fraudulent charges would be best. Real-time monitoring helps keep your growing money safe from theft or fraud.

Diversification

Another way to protect your finances is by diversifying your investments. This means you spread your money into different asset classes, such as stocks, bonds, and real estate.

Diversifying your portfolio is essential to protect yourself from market downturns or other unforeseen events. It would help if you considered consulting with a professional financial advisor who can give you personalized advice on the best strategies for diversification.

With diversification, you can spread out your risk and potentially reduce losses in volatile markets. Having a well-diversified portfolio is one of the best ways to protect your growing money over the long term.

Professional Management

When it comes to protecting your finances, it’s essential to have a reliable investment management service. This is someone who can help you keep track of your investments and make intelligent decisions based on market changes.

An investment management service can also help you grow your money over time. They have the experience and knowledge to navigate the markets and help you reach your financial goals.

It’s essential to do your research before choosing an investment management service. Make sure to read reviews and compare rates. You want to find someone trustworthy with a strong success track record.

The best investment management services will work with you one-on-one to create a personalized plan that meets your needs. They will also be there to help you during times of market volatility. If you’re looking for someone to help protect your growing money, then an investment management service is the right choice.

Final Thoughts

Protecting your growing money is essential for long-term financial success. You can use many strategies, such as building an emergency fund, monitoring your investments in real-time, diversifying your portfolio, and hiring a professional investment management service. These strategies can help you protect your finances from unexpected events and grow your wealth over the years. Investing in yourself is one of the best ways to secure a prosperous future. With the right strategies and intelligent decisions, you can ensure that your hard-earned money stays safe throughout life’s ups and downs.